Emergency Loans

1 Hour Payday Loans

1 hour payday loans can get you the emergency loan cash you need to pay for unexpected expenes, put cash in your pocket, and more. Apply now and see your offer with no affect to your credit score.

1 Hour Payday Loans online No Credit Check

If your credit score isn’t where you’d like it to be, finding a traditional loan can feel like a real challenge. The goods news is it doesn’t have to be.

WeFixMoneyNow.com 1 hour payday loans lenders offer no credit check loan options and focus less on your credit history and more on your income and repayment ability.

These flexible one hour loan solutions are especially useful for those with bad credit or limited credit history.

From payday loans with no credit check to fast online loans tailored for urgent needs, these alternatives are designed to help you access the funds you need.

1 Hour Payday Loan Process

2

Get Same Day Approval

Lenders Review Your Loan Request

3

Funds Direct Deposited

Get Approved & Get Cash As Soon As The Next Business Day.

1 Hour Payday Loan Direct Lenders

Do you beed an wmergency loan? If you answered yes then you are in the right spot. Our 1 hour payday loan direct lenders are online 24/7 and they are ready to accept your application right now.

Why Choose We Fix Money Now?

Our Lenders Specialize in Emergency Loans

We Fix Money Now has direct lenders that will work hard on getting you approved for the one hour payday loan you need.

The application is free, easy to use, and you get an instant decision with in minutes and no impact on your credit score to see your loan offer.

Cash Wired in 1 Hour

Cash wired in 1 hour means once you are approved and you agree to the rate and terms of the loan the lender will release funds with in the hour and will be direct deposited in to your bank account. The 1 hour cash will be ready to spend as soon as one business day.

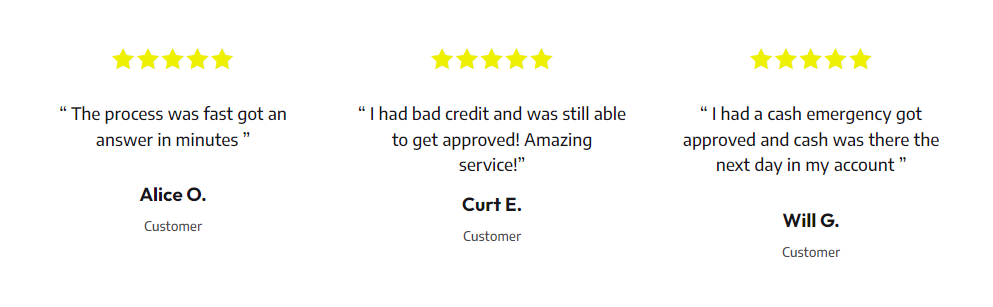

1- Hour Payday Loans Reviews

1 Hour Loans By Phone

1(844) 514-1127

1 hour loans

-

Can I really get a payday loan in 1 hour?

Yes, many lenders offer quick approval processes that can take just minutes. However, while approval may be fast, actual fund disbursement typically occurs within 1 business day, depending on your bank’s processing times.

-

Do 1 hour payday loans require a credit check?

Often, no. Many lenders provide “no credit check” payday loans, utilizing soft inquiries or alternative data, which do not impact your credit score.

-

What are the eligibility requirements for a 1 hour payday loan?

- Be at least 18 years old

- Have a valid ID

- Possess an active checking account

- Provide proof of income (e.g., pay stubs or bank statements)

-

How much can I borrow with a 1 hour payday loan?

Loan amounts vary by state and lender. check your local state laws for more information.

-

What are the typical fees and interest rates?

Payday loans often come with high fees and interest rates. Annual Percentage Rates (APRs) can range significantly higher than traditional credit options.

-

Will a payday loan affect my credit score?

Generally, payday loans do not impact your credit score unless you default. Most lenders do not report to credit bureaus, but failure to repay can lead to collections, which may harm your credit.

-

Are there penalties for early repayment?

Typically, no. Many payday lenders allow early repayment without additional fees. However, it’s essential to review the loan agreement, as terms can vary.

-

What happens if I can't repay the loan on time?

Failure to repay on time can result in additional fees, increased interest rates, and potential collection actions. It’s crucial to understand the repayment terms before borrowing. if you will have issues making the payment contact your lender and see if there are work around options.

-

Are 1 hour payday loans legal in my state?

Legality varies by state. Some states have strict regulations or bans on payday lending, while others permit it with specific guidelines. It’s important to check your state’s laws before applying.

-

Are there safer alternatives to payday loans?

Yes. Alternatives include personal loans from banks or credit unions, payday alternative loans (PALs), borrowing from friends or family, or using Earned Wage Access (EWA) apps.

APR Disclosure

Some states have laws limiting the Annual Percentage Rate (APR) that a lender can charge you. APRs for cash advance loans range from 200% and 1386%, APRs for installment loans range from 6.63% to 225%, and APRs for personal loans range from 4.99% to 450% and vary by lender. Loans from a state that has no limiting laws or loans from a bank not governed by state laws may have an even higher APR. The APR is the rate at which your loan accrues interest and is based upon the amount, cost and term of your loan, repayment amounts and timing of payments. Lenders are legally required to show you the APR and other terms of your loan before you execute a loan agreement. APR rates are subject to change. If you have questions about your loan contact your lender directly and for any other questions contact us thriugh customer service.

Material Disclosure

Exclusions

Residents of some states may not be eligible for some or all short-term, small-dollar loans.

Credit Implications

WeFixMoney Now does not make any credit decisions. Independent, participating lenders that you might be connected with may perform credit checks with credit reporting bureaus or obtain consumer reports, typically through alternative providers to determine credit worthiness, credit standing and/or credit capacity. By submitting your information, you agree to allow participating lenders to verify your information and check your credit. Consider seeking professional advice regarding your financial needs, risks and alternatives to short-term loans. How do I reach customer service? You can email us at info@wefixmoneynow.com Fix It money Loans are available to apply for online.

1 hour loans -1 hour payday loans – 1 hour payday loan lenders – 1 hour payday loans online no credit check instant approval – 1 hour payday loans bad credit